PRODUCT MANAGEMENT

A smart, high-performance, electric vehicle NIO's strategic market expansion

Identified optimal emerging markets using economic indicators for sustainable growth, operational viability, and long-term scalability; developed strategies to reduce manufacturing risk and scale expansion.

Hi there! 👋

Thanks for visiting my portfolio.

For the best experience, case studies are currently viewable only on desktop or laptop devices. I recommend checking back from a larger screen to explore them fully.

Appreciate your understanding!

PROBLEM STATEMENT

Which emerging market offers the best conditions for a successful and sustainable entry, and how should NIO expand its smart EV footprint to meet rising global demand, and reduce manufacturing risk?

EXECUTIVE SUMMARY

About This Project:

This strategic project explored NIO’s potential expansion into emerging ASEAN markets. By combining macroeconomic indicators with industry-specific factors, we developed a data-driven framework to guide market selection and entry.

Opportunity:

Global EV adoption is on the rise, especially in regions offering government incentives and favorable conditions for investment. NIO has an opportunity to vertically integrate manufacturing and reach new consumers by entering an untapped, growing market.

Category: Product Strategy & International Expansion

Project Type: MBA Capstone

My Role: Product Strategist (Worked with 5 other peers)

PRODUCT MANAGEMENT PROCESS

Opportunity Identification

Electric Vehicles Industry Overview and Challenges

Electric vehicles (EVs) use electric motors for propulsion and are powered by batteries, fuel cells, or external sources such as solar panels. Although EVs date back to the mid-19th century, their popularity declined with the rise of internal combustion engines. In recent decades, EVs have resurged due to climate concerns, technological advancements, and government incentives.

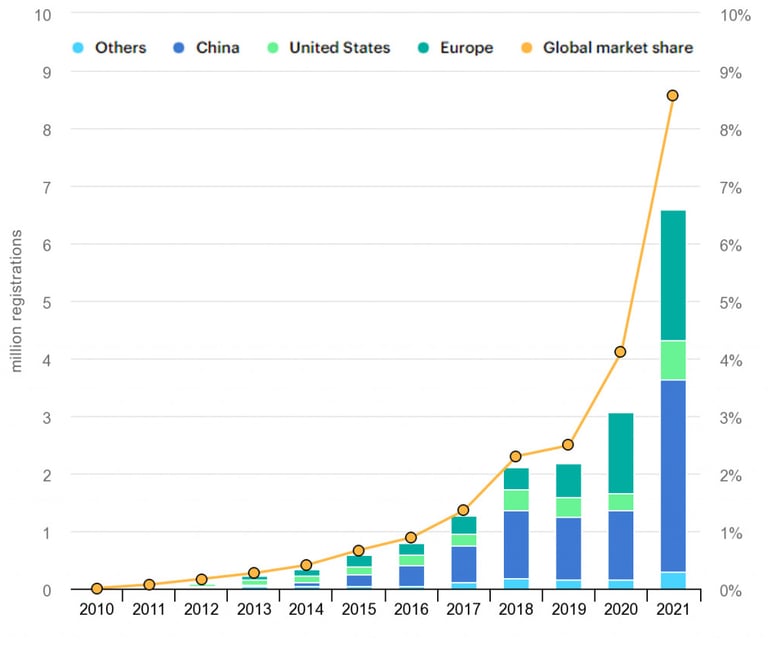

Global EV sales surged in 2021, with 6.6 million units sold—double the previous year. Despite this growth, EVs still make up less than 10% of total vehicle sales, highlighting a large opportunity for expansion.

In Southeast Asia, the adoption of EVs is gaining momentum. Malaysia is slowly enhancing its EV ecosystem through planned investments in charging infrastructure and policy updates. Thailand has a more mature EV strategy, aiming to manufacture over a million EVs by 2036.

Limited charging infrastructure compared to traditional fuel stations

Grid strain risks due to increased electricity demand

High-carbon electricity in many regions, which reduces EVs' environmental benefits

Dependency on rare earth minerals, increasing manufacturing complexity and cost

CHALLENGES IN ELECTRIC VEHICLE INDUSTRY

DISCOVER

NIO Company Profile

Founded in 2014 and headquartered in Shanghai, NIO is a premium electric vehicle manufacturer with operations in China, Europe, and the U.S. The company is known for innovations like battery swapping and autonomous driving technology. Its product line includes midsize to large electric SUVs and sedans.

In 2021, NIO sold over 91,000 vehicles, accounting for 2.7% of China's EV market. As of mid-2022, it had sold nearly 218,000 vehicles cumulatively.

NIO currently manufactures vehicles through a joint venture with JAC Motors in China. While this partnership has enabled growth, it also introduces risks.

Delays in manufacturing

Volumes not meeting NIO’s demand

Potential disputes with manufacturing partners

NIOs ability to build a premium brand depends on quality delivered by an external manufacturer

Once contract expires, the expense and time required to complete any transition to a new manufacturer would be burdensome.

CHALLENGES IN CONTINUING PARTNERSHIPS WITH JAC MOTORS

Vertical Integration for Risk Mitigation and Market Control

To address the operational risks tied to its reliance on contract manufacturing—such as quality control, delivery delays, and limited scalability—NIO is exploring vertical integration by establishing its own assembly and production facilities in emerging markets.

Entering emerging markets for EV manufacturing presents a distinct set of challenges:

Securing sufficient capital investment

Access to advanced infrastructure and utilities

Recruiting, training, and retaining skilled talent

Navigating evolving and complex regulatory frameworks

Leveraging government incentives for foreign investment and local EV production

Building a resilient and localized supply chain for key components and raw materials

Ensuring market readiness through charging infrastructure and system standardization

Addressing consumer concerns around affordability, charging convenience, and EV reliability

CHALLENGES IN EMERGING MARKET EXPANSION

PROBLEM WORTH SOLVING...

NIO's reliance on a contract manufacturer (JAC) presented scalability and control risks. Expansion into a new market could address this by enabling vertical integration while capturing new consumer segments with a localized product line.

Market Research

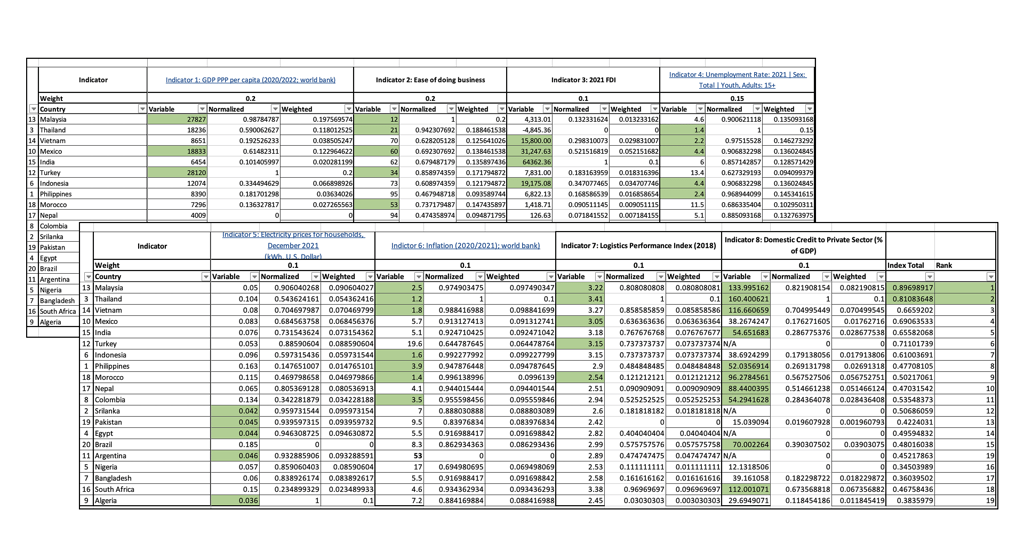

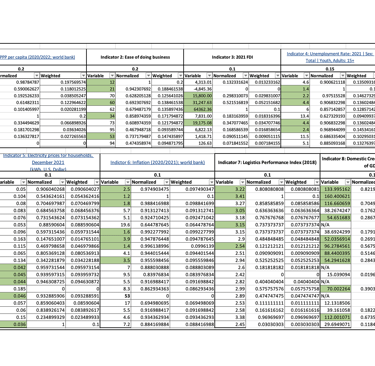

In short, the conditions were ripe—but fragmented. We needed to go deeper. To evaluate each country’s readiness for EV adoption and NIO’s manufacturing ambitions, we built a weighted index based on eight macroeconomic indicators, including GDP per capita, ease of doing business, FDI flows, energy costs, and access to credit. We overlaid this with EV-specific data—charging infrastructure, tax incentives, labor costs, and export capabilities.

Malaysia and Thailand emerged as the top two contenders. But as we layered in strategic priorities like vertical integration, electronics supply chain maturity, and policy alignment, Malaysia stood out as the ideal launchpad.

Why Malaysia?

Our comparative analysis showed that Malaysia offered the perfect confluence of conditions: skilled labour, government incentives, and a growing electronics industry—making it an ideal location.

Discovering the Next Growth Frontier

Our first step was identifying high-potential markets across ASEAN, a region that had long remained underserved by major EV players. We were drawn to Southeast Asia for three reasons:

Low EV penetration but rising demand

Pro-EV government mandates and investment programs

A fast-growing middle class seeking affordable mobility

STRONGER GDP PER CAPITA

Higher purchasing power among consumers

ROBUST ELECTRONIC EXPORT INDUSTRY

Critical for EV component production

GENEROUS EV TAX INCENTIVES

Full exemptions on import, excise, and sales taxes

HIGH UNEMPLOYMENT

A ready pool of labor for manufacturing ramp-up

GOVERNMENT ALIGNMENT

Support through NAP 2020 and green mobility policies

Thailand, while a strong player in automotive manufacturing, was slower in FDI recovery and offered fewer strategic advantages in electronics—a key differentiator for NIO’s tech-forward vehicles.

VALIDATE

Strategy Development

With Malaysia selected, we developed a three-phase go-to-market strategy aligned with the country's market maturity and NIO’s operational objectives. Malaysia’s pro-business environment, rising consumer readiness, and active infrastructure development position it as a strategic launchpad for NIO to enter, scale, and lead the ASEAN EV market.

Set up a low-cost parts assembly plant leveraging local labor and incentives. This reduced initial investment and allowed NIO to build familiarity with the market.

This stepwise approach enabled agility while mitigating manufacturing risk post-JAC. This phased approach also reduces upfront investment and allows NIO to test market readiness.

PHASE 1

Transition to full vehicle manufacturing with domestic supply chain integration, especially in semiconductors and EV batteries.

Launch a value-based EV model priced around MYR 49,500 (~$11,100)—specifically designed for affordability, urban use, and local infrastructure conditions.

PHASE 2

PHASE 3

BUILD

DESIGNING THE RIGHT PRODUCT FOR THE RIGHT MARKET

We then shifted to product planning, aligning vehicle specifications with the needs and income levels of ASEAN consumers. Our focus was on developing a new value-oriented EV product line by

Aligning price points with GDP per capita and average salaries

Minimizing range anxiety with battery swap/charging support

Creating a “smart” but cost-conscious car for urban ASEAN consumers

The ultimate goal was to deliver an intelligent, affordable EV that could leapfrog the traditional barriers to adoption in emerging markets.

Go-to-Market Planning: Channel, Partners, and Positioning

With limited EV competition in Malaysia, NIO has a unique opportunity to shape consumer perceptions early and establish itself as a leader in the premium-affordable segment. The market remains underpenetrated by major EV brands, enabling NIO to capture early market share, build strong brand recognition, and advance its strategy of reducing reliance on contract manufacturing by localizing production.

POSITIONING

Collaborate with local manufacturing and semiconductor firms

Tap into Malaysian EV policy programs (e.g., NAP 2020, Low Carbon Mobility Blueprint)

Initial rollout via online pre-orders + flagship experience centers

Leverage government support for charging infrastructure rollouts

Introduce NIO as a high-tech, green, and affordable EV brand, first to operate at scale in Malaysia’s underserved EV segment.

PARTNERSHIP STRATEGY

CHANNELS

LAUNCH

Measuring Success: KPIs and Risk Management

To monitor performance and adapt quickly, we defined key metrics:

Ramp-up speed and production cost

Local hiring and training outcomes

Policy compliance and investment efficiency

Pilot-region consumer uptake

We also mapped critical risks—supply chain fragility, regulatory complexity, infrastructure gaps, Consumer skepticism about EV reliability and support—and baked them into our execution and contingency plans.

To monitor performance and adapt quickly, we defined key metrics:

Ramp-up speed and production cost

Local hiring and training outcomes

Policy compliance and investment efficiency

Pilot-region consumer uptake

We also mapped critical risks—

Supply chain fragility

Regulatory complexity

Infrastructure gaps

Consumer skepticism about EV reliability and support

and baked them into our execution and contingency plans.

KPIs

RISK MANAGEMENT

EVALUATE

Scaling Beyond Malaysia

Success in Malaysia would serve as a strategic springboard for NIO’s broader Southeast Asia expansion. To support this, we built feedback mechanisms into the rollout strategy, allowing the company to refine key aspects—such as product features, pricing, and service models—before entering other high-potential markets. This ensured flexibility and responsiveness in a dynamic regional environment.

Key scaling elements

REGIONAL EXPANSION TARGET

Plan to evolve from entry-level EVs to mid-range models as consumer needs and purchasing power increase.

Real-world insights used to continuously iterate on offerings and go-to-market strategies.

Thailand, Vietnam, and the Philippines identified as next-entry markets based on demand signals and infrastructure progress.

PRODUCT PORTFOLIO GROWTH

FEEDBACK LOOPS

A phased, data-informed approach designed to support sustainable scaling across diverse markets.

ADAPTABLE FRAMEWORK

ITERATE

What I learned?

Through this project, I deepened my ability to make complex, multi-variable decisions that balance product strategy, operational realities, and long-term business goals. It reinforced a key principle of product leadership in emerging markets: think systemically, act locally.

From index modeling and pricing strategy to channel design and policy navigation, this capstone showcased how structured thinking and on-the-ground alignment can unlock sustainable, scalable market entry for a global innovator like NIO.